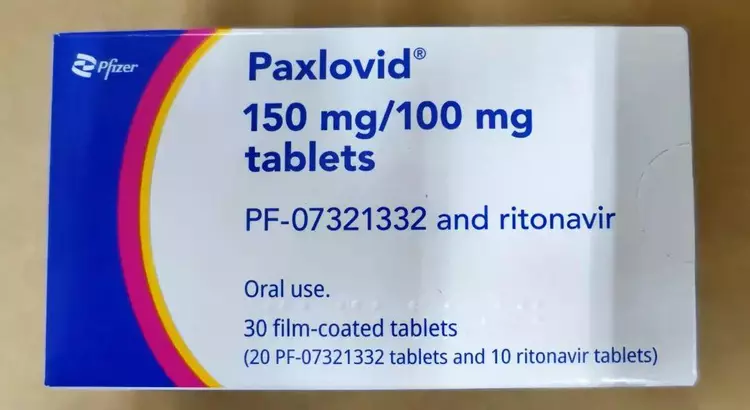

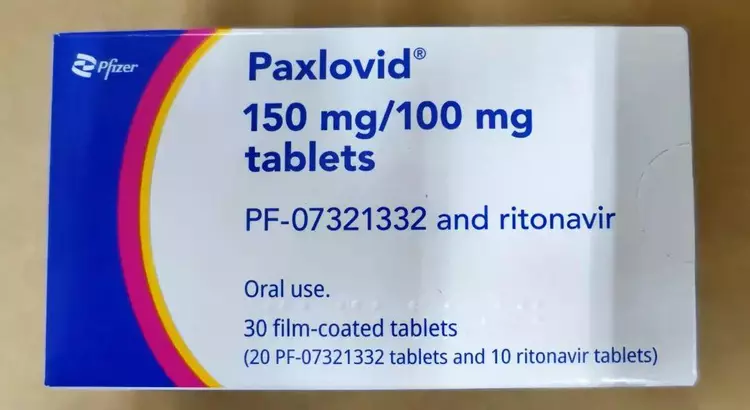

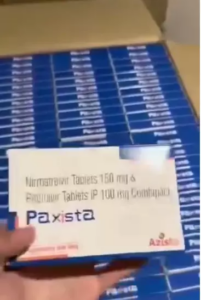

Pfizer: allow China strong generic Paxlovid news is not true, as soon as 3 to 4 months to achieve local production in China

Whether Pfizer Paxlovid can be strongly generic in China, when it will be produced and how to secure supply, reporters obtained information from Pfizer China officials on Jan. 10. Pfizer said that negotiations between Pfizer and China on the pricing of Paxlovid in China have been interrupted because the price requested by the Chinese government is lower than the selling price of Paxlovid in low- and middle-income countries, and that reports that the Chinese side is communicating with Pfizer about allowing local pharmaceutical manufacturers to produce generics and sell them are inaccurate; although Paxlovid has failed to be included in the national medical insurance catalog. Pfizer will continue to cooperate with the government and other relevant partners to ensure adequate supply of Paxlovid in the Chinese market in order to continue to meet the needs of Chinese patients for the new crown treatment, and localize the production of the new crown oral drug Paxlovid through local Chinese partners in the next 3-4 months.

File photo

Previously reported

Pfizer talks for more than four hours on the third day of medical insurance negotiations

On January 7, the third day of national health insurance negotiations delayed by the New Crown epidemic, the main event was staged, with several heavyweight products in the fields of oncology and rare diseases being negotiated, and the much-anticipated Pfizer New Crown drug Paxlovid may have been negotiated in the morning.

The reporter saw at the negotiation site that Qian Yun, vice president of Pfizer Global Biopharmaceutical Commercial Group China and head of market access, entered the negotiation infield at 8:30 a.m. and did not come out from the negotiation infield until 1:20 p.m., which was close to the entry time of the afternoon field companies. The negotiation time for each drug is half an hour as stipulated by the Medical Insurance Bureau.

The morning session officially began at 9:00, according to this calculation, Pfizer today talked for more than 4 hours.

On the 7th, Baekje Shenzhou (06160.HK/688235.SH) was led by Yin Min, chief commercial officer of Greater China, and Wu Xiaobin, president, chief operating officer and general manager of Baekje Shenzhou in China, also sat outside the field in civilian clothes; Osram Ou, global vice president and general manager of AbbVie in China; Zhu Ning, head of market access and commercial operations of GlaxoSmithKline in China; and Beda Pharmaceuticals ( 300558.SZ) senior vice president and chief operating officer Wan Jiang, etc., entered the negotiations.

The reporter also learned that if the negotiations are successful, the company needs to bring the agreement back to the company to go through a series of processes such as stamping, and then return the official agreement with the official seal to the Health Insurance Bureau. This time, the medical insurance bureau only gave enterprises 3 days to complete this process, while in previous years, this process has 7 days.

A number of business people speculate that the Health Insurance Board is speeding up the process, perhaps to announce the results of the negotiations before the Chinese New Year and release the new version of the health insurance catalog.

Pfizer P drug or the end of negotiations

The most concerned drug in this health insurance negotiation is undoubtedly Pfizer’s new crown oral drug Paxlovid.

Including Paxlovid, this year’s health insurance negotiations, Pfizer has a total of seven products. Qian Yun appeared at the negotiation site in the afternoon of the 6th. But according to industry sources, Paxlovid was negotiated in the morning of the 7th.

Unlike other companies, Qian Yun walked out of the negotiation site at 1:00 pm alone.

Paxlovid was approved in China in February 2022 and was then used in the Shanghai outbreak in March 2022. By the end of 2022, with the epidemic prevention and control situation changed greatly, Paxlovid and domestic Azivudine, as well as quickly become the new crown oral drug of national concern.

It is understood that Azivudine also participated in the medical insurance negotiations this time, and the indications talked about were for the treatment of AIDS. Since the new crown indication was approved in late July 2022, after the time window of this medical insurance negotiation, the new crown indication did not enter this medical insurance negotiation.

Data Chart

Coincidentally, just in the evening of January 6, the Office of the National Health Insurance Administration issued a Notice on “Guidelines for Price Formation of New Crown Therapeutic Drugs (for Trial Implementation)”, which provides the institutional framework for regulating the price of new crown drugs.

According to the above notice, Paxlovid and other new crown therapeutic drugs approved before January 1, 2023 are to be proactively reassessed and dynamically adjusted in price, while new crown therapeutic drugs approved after January 1, 2023 are to be first quoted in accordance with the above notice guidelines.

On December 28, the price of Paxlovid was lowered to RMB 1,890/box in some places. And on December 30, Merck Sharp & Dohme’s new crown oral drug Monoprevir capsules have been approved by the State Drug Administration’s emergency conditional approval, the first batch of Monoprevir has arrived in Waigaoqiao Free Trade Zone warehouse on January 4.

The industry generally believes that the approval of monoprevir has accelerated the price reduction of Paxlovid. In addition, the new crown drug Enzetuvir from Japan’s Shionogi and the new crown drug 3CL protease from Centrum Pharmaceuticals are also approved soon, which also brings price pressure to Paxlovid.

On the second day of the medical insurance negotiations on January 6, news spread in the industry that the price of Paxlovid would be lowered to 700 yuan/box after this medical insurance negotiation.

In fact, Paxlovid has a strict indication for the treatment of adults with mild to moderate novel coronavirus pneumonia with high risk factors for progression to severe disease, such as patients with advanced age, chronic kidney disease, diabetes, cardiovascular disease, chronic lung disease, and other high risk factors for severe disease. In practice, the drug is commonly used within 5 days of the onset of symptoms. In other words, the drug is used to prevent transfer to serious and critical illnesses, not to treat serious and critical illnesses.

According to the confidentiality agreement signed between the Health Insurance Bureau and the companies involved in the negotiations, the companies are not allowed to disclose details such as the negotiation results and the negotiated agreed price before the results are announced, so whether Paxlovid was successfully negotiated and what the agreed price would be if the negotiations were successful are not yet known.

Other heavyweight drugs

The only CAR-T drug that made it to the preliminary review list in this health insurance negotiation is WuXi Juno’s Regiolensai injection, Fosun Kite’s Aquilensai injection is not in the list that passed the preliminary form review.

However, the published price of Regiorense injection is 1.29 million yuan per injection, which is slightly higher than the price of Argirense injection at 1.2 million yuan per injection. 2021 The health insurance negotiations just ended in November, the National Health Insurance Bureau came out and said that Argirense injection only passed the formal review and did not enter the health insurance negotiation process.

Therefore, it is still unknown whether Ruiji Aurense injection will appear in the health insurance negotiation site this year. However, because the National Health Insurance Bureau has the unspoken rule of “no negotiation over 500,000 and no entry over 300,000”, and the preparation process of CAR-T is extremely complex and costly, it is very difficult for CAR-T to enter the health insurance.

PD-1/L1 is still the focus of attention every year. The “Four Little Dragons”, Hengrui Pharmaceutical (600276.SH), Baiji Shenzhou, Cinda Bio (01801.HK), and Junshi Bio (01877.HK/688180.SH), which were previously in the medical insurance catalog for PD-1, are all facing negotiations for new indications this year, and each of them has a big indication.

The new entrants also include Fulvonghanlin’s srulizumab, and Corning Jereh/Thought Di/ Centrum Pharmaceutical’s envelopimab.

With competition from various companies and price pressure from health insurance negotiations, including those not in the catalog, most PD-1s are currently priced between 30,000-50,000 RMB. Economic Observation Network learned that there are PD-1 new entrants in the price is not prepared to significantly reduce the price, because the original pricing is also very low, into the medical insurance has not much impact on the actual sales.

In terms of rare disease drugs, Takeda Pharmaceutical’s hereditary angioedema treatment drug Ranalizumab, Goshen disease treatment drug injectable Virasidase alpha, Sanofi treatment of mucopolysaccharide storage disease injectable Laronidase concentrated solution, Goshen disease treatment drug injectable Virasidase alpha have passed the preliminary form review.

However, according to the reporter’s understanding, a number of the above rare disease products also failed to reach the negotiation table because of the unspoken rule of “no negotiation over 500,000 and no entry over 300,000”.

Average Rating